Are Fintech Plugins the Future?

Customer acquisition costs make standalone Fintechs expensive to scale. Could partnerships and plugins be the answer?

👋 Hey I’m Abe (@abe_clark). I’m currently exploring startup ideas and talking to as many smart people as I can find. This article expresses my current views on the future of Fintech.

tldr;

Fintech will become a plugin ecosystem where aggregators partner with service providers for a full product suite.

This setup optimizes for lower systemic acquisition cost, higher confidence in KYC / fraud protocols, and other key advantages.

Rewind 20 years. Financial services looked a lot different. Your bank was the center of anything involving money. You want a checking/savings account? Head to the branch. You want a mortgage? Head to the branch. A personal loan? Same story.

This made service discovery easy for consumers. Walk into a branch with a need, walk out with a solution.

The tradeoff is that there was no way for the consumer to optimize for service quality and price. If you banked with Chase, you got what Chase had to offer, at Chase's terms and on their timeline.

Hello Fintech

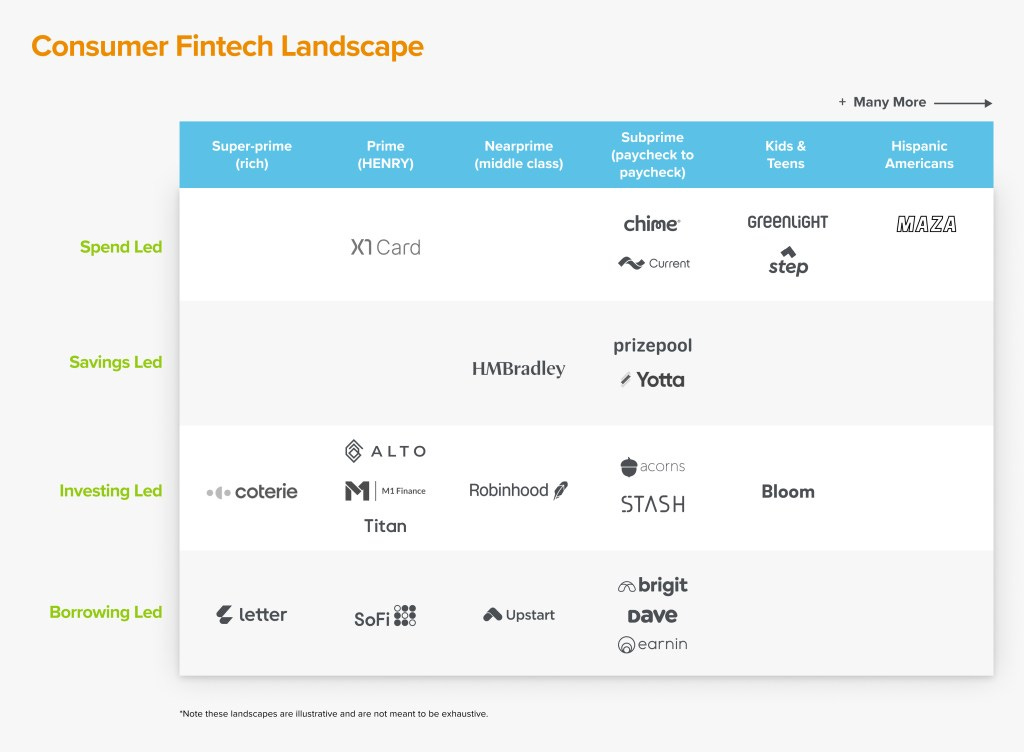

Today, things look much different. The strategy of challenger banks and other Fintech companies has been:

1) Focus on a single service (ex: checking/savings)

2) For a single customer segment (ex: subprime)

3) Create a phenomenal experience at a good price (ex: free accounts, no overdraft)

The above example references Chime. The same can be said of SoFi, Mercury, Robinhood, etc. These companies have been successful in clawing away customer segments from the incumbents.

Growth is Expensive

This targeting strategy works. But it's not cheap. It turns out the service discovery part is costly. User acquisition is expensive (and getting more expensive).

Chase got this part right. Their product suite allows them to amortize user acquisition costs over several monetization channels. Sure, it may cost a few hundred dollars to acquire a customer. But, that customer is for life and you have high confidence in future cross-sells.

Most Fintechs by contrast are a one-trick pony. They are forced to amortize user acquisition costs over just one product offering. Put differently, the systemic cost for service discovery has increased by a factor of n, where n is the number of discrete products.

Future Prediction

What does this mean for the future of Fintech? You'll see a re-bundling happen where companies augment their product suite to optimize for cross-sell.

This can play out two ways:

1) Aggregators buy other Fintechs to widen their offering (Lemonade + Metromile, SoFi + Lantern, etc.)

2) Aggregators partner with other Fintechs to offer a cobranded or private label embedded experience

M&A will certainly be an option for some big players. However, I see option two playing out in greater force.

The main reason is that the new aggregators will still be focused on tight customer segments or industry verticals. The service providers, by contrast, offer a product that is more generally applicable.

It will almost never make sense for a company focused on an industry vertical or narrow customer segment to build these core services in house.

Plugin Ecosystem

Option 2 will lead to a plugin ecosystem in Fintech. Companies offering ancillary services (Insurance, Personal Loans, Mortgage etc.) will shift to focusing on offering:

A simple API + SDK where a partner can engage with limited dev work (Stripe for X)

A streamlined way to setup a joint venture or partnership agreement

A closed-box data sharing agreement where the partner can screen customer profiles for pre-approval in a zero-knowledge environment

Tailwinds

Customer acquisition cost is a driving factor in this movement. But there are several other key points that work drastically better in a plugin model

KYC & Fraud -- When you own customer acquisition you also need to own KYC and fraud protection. When a customer comes from another business, you can use their track record and data to make better decisions.

Customer UX -- Customers want a central place to see and interact with their finances. Credit Karma and a host of others have tried to leverage Plaid data to solve for the customer seeing their finances. But these interfaces are generally read-only. Real utility comes when you can read and write without interacting with 14 different mobile apps or websites.

Curation -- Customers like it when a person or brand they trust makes decisions for them. In this context, they are less price sensitive than we're led to believe. Knowing that SoFi or Chime trusts a service provider is very meaningful.

Who will be the aggregator?

The easiest way to understand who will become an aggregator is to consider how many times a week a consumer will need to interact with a service.

Most Fintech products have a short period of high-touch followed by years of low-touch. For example: getting a mortgage. Underwriting is high-touch and lasts for a month. Servicing is low-touch and can extend for an additional 30 years.

A mortgage company therefore is a good candidate to be a plugin, not an aggregator.

In contrast, consumers use their checking and credit accounts daily for purchases and check their balances at least weekly. Consumer balance and spend applications are good candidates to become aggregators.

Concerns

The concern for plugins becomes -- "how do we avoid becoming a commodity". This deserves serious thought and will look different for each company.

Not owning the customer relationship means that switching costs are relatively small for the aggregator. The upside for the consumer is that this puts real pressure on the plugin to maintain the best service quality and price.

Even with this concern, I'm optimistic that the plugin will retain as good or better economics vs. operating separately. The aggregator/plugin system inherently has less systemic cost. In today's model, customer acquisition cost accrues to players outside of this system (Facebook & Google). Minimizing payments outside the system maximizes the economics for partners.

It has begun

The ultimate example of success with this model is Stripe. They have embedded as the payments layer across a huge percentage of applications inside and outside Fintech.

Their product experience is so good that it's not even a choice which provider you'd use. Stripe has been able to maintain their margins while growing exponentially.

The most recent announcement of the Stripe+Apple partnership is yet another flex. Left untouched, Stripe will continue to roll up the plugin ecosystem.

Some banking as a service providers have also picked up this thread by offering pass-through APIs to a brokerage or target yield accounts via an external RIA.

I’m sure even more entrepreneurs are currently building in the space.

Opportunities

There are lots of ways to ride this wave.

1) Develop an open source framework for easy integration between Fintechs. Open Banking and others have taken a crack at parts of this market. I imagine the winner ends up looking similar to Shopify, but for embedded Fintech delivery.

2) Take a private-label-first approach to building a service line. For example, spin up a personal loans business that only acts as a partner to existing Fintechs.

3) Create a closed-box data sharing framework that allows Fintechs to collaborate on KYC / Fraud / Prequalifications without explicitly sharing data.

4) Create a consulting service focused on building out APIs and SDKs for Fintechs

These are just a few. Fintech is a tidal wave.

Closing Thoughts

I'm bullish on this version of the future of Fintech. I'm also excited to hear where I'm wrong and what I'm missing. Let me know!

If you found this article interesting, subscribe and follow me on twitter @abe_clark

Your analysis is quite precise, and spot on. But you haven't taken into account 2 things the wave of decentralisation demand from consumer & the red tape regulations which prevent such partnerships. Those factors may dial down the segments these plugins will work.

I also a see a possibility of revers plugin, where the consumer facing aggregators like current/savings or payment process wallets. Taking in the heavy lifting of acquiring expensive customers and engage in ease of access of other products. Or else there can be giants like CRED India inc , who enter into the market with the some purpose of acquiring customers with reward, get the processing of payment through them directly or indirectly, rank them and re sale them Exclusively/ Non exclusively. I personally stay away from those app.