Interchange: Here Today, Gone Tomorrow

We've reached peak interchange. Wise Fintech's will diversify revenue.

tldr;

Interchange revenue is here today, but not guaranteed tomorrow.

Startups should view interchange as a bootstrapping mechanism, not as a long-term business model.

Macro headwinds include strong tech adoption by merchants, peer-to-peer payment platforms & digital wallets, crypto, and legislation.

This article is not meant to be a primer on interchange. If you’re new to interchange, consider reading this piece from Unit.

Here is the quick version: On a $1 purchase, only 97 cents go to the retailer. The other 3 cents are split between several parties, with the bulk going to the Fintech that issued the card.

Interchange is the primary revenue model for most Fintech companies.

Fintech companies usually derive more than 75% of their revenues from interchange fees — Unit.co

Predicting the Future

Founders are in the business of predicting and then building the future. Turns out the future is hard to predict. The accuracy of a prediction fades each incremental year it projects.

For this reason, many of us are tempted to extrapolate current trends to indicate what the next 2-4 years will bring. Of course, a startup may take upwards of ten years to reach an “exit” and a good exit only comes if the company is still accelerating.

This means that successful founders need to be able to predict what the world looks like 10-15 years in the future.

Extrapolation of current trends breaks down over a longer time horizon.

The Fintech ecosystem (including economic models like interchange) will look vastly different in 10 years. Entrepreneurs who over-index on the status quo will begin to feel real pain in year 5+.

Interchange Business Models

Two common startup models today are:

SaaS —> Financial Stack

Find a neglected vertical with an old SaaS stack

Replace the SaaS stack with a free offering

Require that clients use your banking and/or payments stack

Monetize via interchange

Neobank

Target a specific customer segment

Build a balance & spend platform optimized for their needs

Monetize via interchange

Both of these models are genius. Assuming interchange is a constant, I’d invest in these companies all day.

The problem is, on a 10-year horizon, interchange isn’t a constant. In fact, it’s almost guaranteed to evaporate.

Learning From Checks

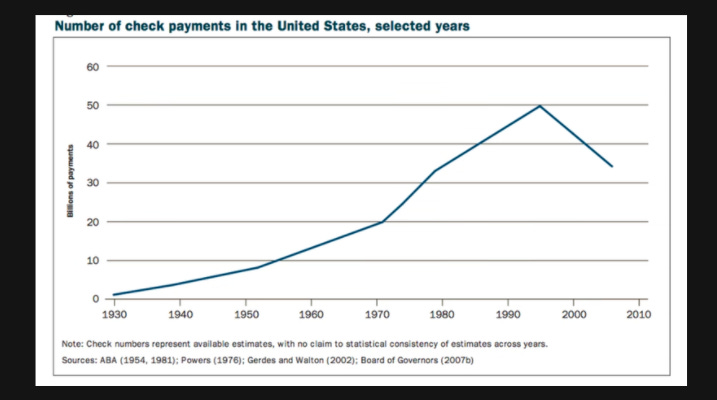

Checks were once state-of-the-art. They boomed in popularity after World War II. Checks finally peaked in the mid-90s, about 40 years after plastic cards and ACH were introduced.

The move from cash to checks required a large amount of operations and logistics to pull off. Banks needed to be able to issue, verify, and remit payment based on paper. It’s no wonder that it took 70 years to reach peak adoption.

The same steep implementation curve was true for plastic cards. All merchants needed new hardware and software. We’re currently right around the 70 year mark since plastic cards were introduced.

2020 was the first year in history where the number of card transactions declined. COVID had an impact here, of course. The impact was to accelerate the demise of card usage by incentivizing the adoption of digital wallets, peer-to-peer payments, and ACH.

If someone pitched you on a check startup today, you’d probably bust up laughing. It’s clear now that checks are not the future because they have been in decline for over two decades.

We’re currently at the turning point for cards. Can you build a profitable business based on cards and interchange? Of course. How long will it last? Worth deeper thought.

Displacing Cards

If you displace credit and debit cards, you displace interchange. There’s a huge incentive to do so. Interchange is an effective 3% global tax.

Centralized payments infrastructure

The adoption velocity of new payments technology is accelerating. This is due to the centralization and standardization of payments infrastructure. Using Stripe, retailers can enable a new payment method with the click of a button:

Similarly, NFC readers are now commonplace for point-of-sale hardware. This means new software can interact with current hardware for in-person transactions.

Mobile wallets (GooglePay, ApplePay, etc.) as well as peer-to-peer platforms (Venmo, CashApp, etc.) make it very possible to sidestep the card networks in favor of ACH transactions. Even Zelle, arguably the least likely joint venture to succeed based on pedigree, has seen amazing success.

The centralized platform owners have ultimate leverage on the future of payments. I’m convinced that the next 2-3 years will bring some groundbreaking products from these players.

If you’re skeptical of Apple and Google’s willingness to shake things up, consider Apple’s app privacy updates as a harbinger. Apple’s position as a centralized hardware and software provider allowed it to claw away nearly half of Facebook’s market cap. All this to benefit and build loyalty with Apple’s core users.

I wonder how many Apple users would enjoy not paying interchange?

PoS is dying

I mentioned the flexibility of current point-of-sale systems above. The truth is, PoS is also dying. Amazon Go’s checkout-free experience demonstrates a shopping paradigm where payment happens via an existing account, automatically.

As the online shopping experience continues to bleed into brick-and-mortar, we’ll see even more companies following this trend. If you don’t need to swipe a card at checkout, do you need a card at all?

The 70-year mass adoption cycle of checks and cards will be much shorter for future payment innovations.

Crypto

Crypto is an obvious candidate for disrupting the interchange model (…or replacing it with gas fees?). Crypto is especially compelling as a way to accelerate adoption internationally.

Loyalty Programs

It’s wacky that your credit card company gives you kick backs for certain brands. Brands are going to short circuit this and have loyalty + payment programs akin to Starbucks and Target.

Legislation

In 2011 the Durbin Amendment went into effect. This ruling capped the interchange that large banks could charge at 0.05% + 21 cents. Prior to Durbin amendment, unregulated fees were about 44 cents per transaction.

This amendment offers a glimpse of what subsequent legislation could do to shake up the margins in this space. Especially as legislators realize that the marginal cost of payments continues to decline.

So What?

If you’re building a business based on interchange, you’re probably fine for now. Don’t panic. Do invest serious thought into how you can adjust the business in the event that interchange slips away.

BaaS providers and card issuers should become as close as possible to the payments infrastructure players (Apple, Google, Stripe). Ideally they can strike a deal to partner on any new products those players decide to roll out. The temptation will be to resist due to the risk of cannibalization.

Closing Thoughts

This is not intended to be a “All these companies are going to die” post. Instead, I hope it serves as encouragement for startups to think about proactively diversifying their revenue streams early.

A great way to do this is by partnering with other Fintechs to offer a more full product suite and sharing the profits.

I’m also excited to hear where I’m wrong and what I’m missing. Let me know!

If you found this article interesting, subscribe and follow me on twitter @abe_clark